Memphis, Tennessee

Memphis is home to FedEx World Headquarters and Superhub, employing over 30,000 people. Proximity to customer base and temperate weather to keep deliveries on time led FedEx to choose Memphis in 1973. Those same attributes have kept FedEx HQ in Memphis ever since and has led UPS and USPS to open major operations in the city. Referred to as “America’s Distribution Center,” Memphis is uniquely positioned to provide cost effective distribution and logistics services. By train, Memphis can reach 45 states, as well as Canada and Mexico, within two days. Employer workforces are attracted to Memphis with a cost of living that is 15% below the national average.

SOUTHEAST SUBMARKET

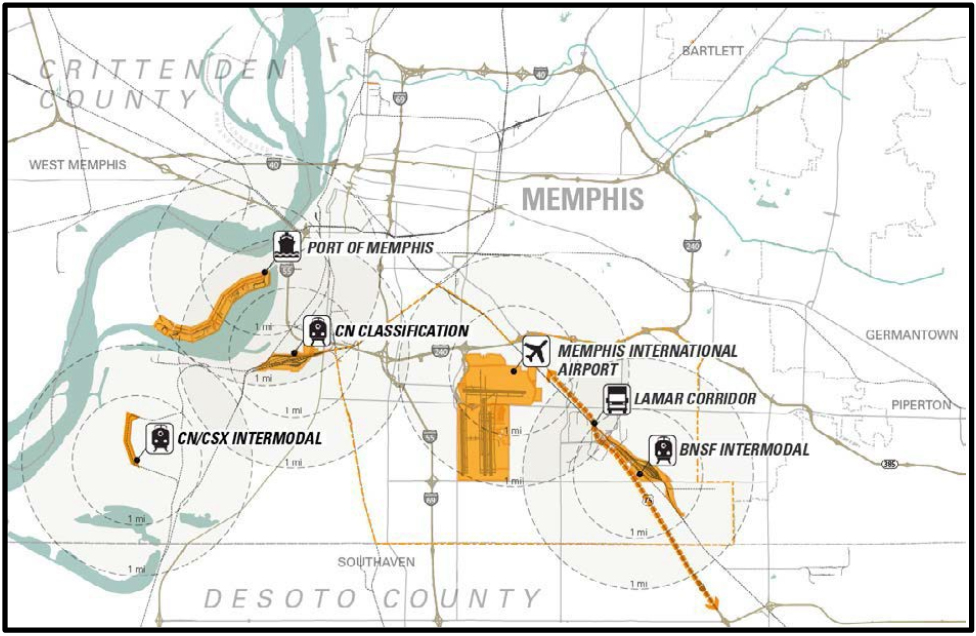

The four-property portfolio is located in the Southeast submarket of Memphis directly in-between the airport and the BNSF intermodal yard. Memphis International Airport houses FedEx’s 863 acre 2.2M SF World Air Superhub and its 200,000 SF FedEx Ground Hub. Aircraft take off and land every 90 seconds between 11pm and 4am. UPS is planning an $80M expansion that will double their 300K SF distribution center on the east side of the airport. The move is seen as a first step in the company’s plans to increase its presence in Memphis. Other notable deals (new, renewal, expansion, or sublease) within the submarket include Nike (~2M+ SF), Ford (~1.4M+ SF), and Target (~900K SF). The BNSF intermodal facility is located just a short five-minute drive down US-78/Interstate 22. BNSF is the No. 1 intermodal carrier among U.S. railroads. In recent years, a 185-acre expansion increased the facility’s capacity from 250,000 annual cargo lifts to 1,000,000+ annually. The facility can also hold an inventory of more than 6,000 trucks. The expanded facility features six 7,500-foot intermodal tracks for loading/unloading goods and three truck drive aisles.

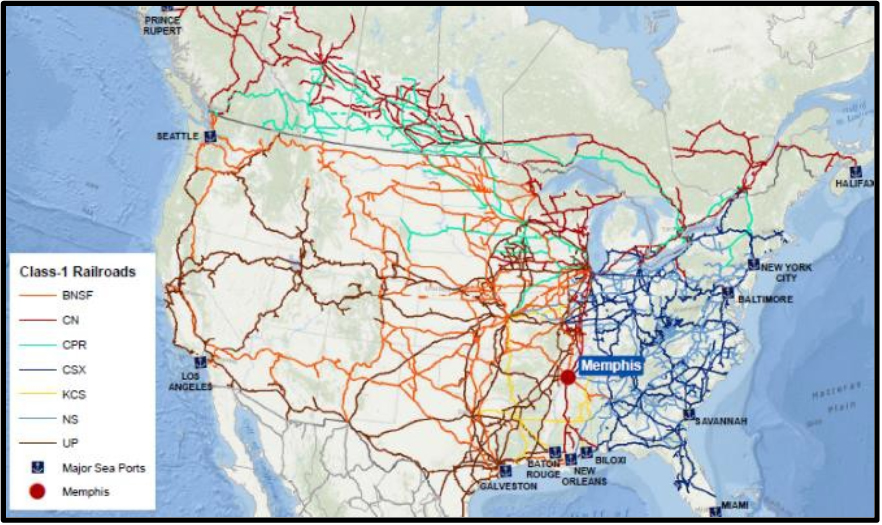

According to CBRE, the Southeast submarket consists of nearly 97M of the 235M SF (41%) of industrial space within the Memphis MSA. They have recorded more than 23M SF of leasing activity since 2012, nearly double that of the next most active market. There is an undersupply of industrial distribution space in the US projected to last at least 20 years, based on top-of-cycle supply and demand dynamics. Recessionary periods may extend this imbalance. The intersection of Class I railways, highways and critical intermodal hubs will define the future of industrial distribution locations. Major new intermodal hubs are required to facilitate new corridors of trade and lessen dependence on truck transport. Memphis is perfectly centered to take advantage of these changes.

MARKET OVERVIEW:

- Since 1992, the Memphis International Airport has been ranked by Airports Council International (ACI) as the top airport cargo facility in North America. The Memphis International Airport is ranked as the 2nd busiest air cargo airport in the world. It is second only to Hong Kong on the list of World’s Busiest Air Cargo Airports.

- The city stands as one of only four cities in the US with five Class I railroads and is the 3rd largest rail center in the nation behind Chicago and St. Louis.

- It is served by 7 primary US highways, more than any other city in the Southeast.

- Memphis serves 152 markets (including 40 of the top 100 US markets) through overnight truck service, more than St. Louis, Chicago, Kansas City, and Dallas.

- The International Port of Memphis is the 5th largest inland port in the US and 2nd largest inland port on the shallow draft portion of the Mississippi River.

- The Memphis workforce has more experienced logistics workers per capita than any other top 100 US market.

- • The city of Memphis, located on the southwest corner of Tennessee, has a population of over 655,000, making it the 23rd largest city in the US. The Memphis MSA, consisting of neighboring counties in Arkansas and Mississippi, has a population of 1.35 million people.

- The 235M SF Memphis MSA industrial market currently has a vacancy rate of approximately 8% that is expected to remain relatively unchanged in 2017. Over 14M SF of industrial space was absorbed in 2015 and 2016. Second quarter absorption was 1.2M SF with year-end 2017 totals expected to be on pace with

- 2016. 70% of newly delivered speculative space was preleased. According to CBRE, overall industrial asking rents were $3.11/SF in 2Q2017, continuing increases from previous quarters.

Below is a snapshot taken from recent reports on the Memphis industrial market:

- “While Memphis has been slow to recover from the recession, the long-term outlook is strong.

The market itself is uniquely tied to the success of logistics and the growth of e-commerce. The outlook for the Memphis market is strong because of the rapid growth expected in these areas.”

– 2017 Southeast US Real Estate Market Outlook Memphis by CBRE

- “Looking forward, rates will continue to rise as current tenants renew and new, large tenants seek out Memphis and North Mississippi. Memphis can expect to see absorption and construction activity levels similar in pace to 2016.” – Memphis Industrial & Logistics Q2 2017 by CBRE

- “Looking forward, rates will continue to rise as current tenants renew and new, large tenants seek out Memphis and North Mississippi. Memphis can expect to see absorption and construction activity levels similar in pace to 2016.” – Memphis Industrial & Logistics Q2 2017 by CBRE

Memphis Industrial Insight by JLL

- “Experts with the Federal Reserve Bank of St. Louis are optimistic about the Memphis economy moving into 2017 and expect improvement to slightly exceed the growth reported in 2016. Demand for space is forecasted to remain strong through the new year. The Memphis area is poised for growth in 2017 as vacancy rates drop in larger U.S. markets and investors and tenants increasingly look to secondary markets to fulfill their space requirements.” – Memphis Marketbeat Industrial Q4 2016 by Cushman & Wakefield

TALK TO AN EXPERT

It is TCG’s hope that investors are motivated to build a long term relationship of shared principles, exceptional investment opportunities and successful awe-inspiring ventures with them.

Contact