Part I

Triumph Capital Group 2019 Economic Forecast and Real Estate Investment Strategy: TCG Forecast

By: Paul J. Ruff, Triumph Capital Group Managing Partner

Triumph Capital Group’s analysis of economic indicators suggests a slowing economy in 2019, with a potential for recession, but a downturn that would be relatively mild in its magnitude with or without actual GDP contraction. We are also seeing some factors that could lead to an extension of growth, pushing a slowdown into 2020 or later, but trend analysis reduces the probability of delay. In addition, we see the potential for a big run- up in growth, subject to political influences in 2020, after the downturn. A continued cautious approach to investment and underwriting with a balanced risk profile is appropriate in the new year, while both aggressive growth risk postures or purely defensive postures are likely overkill.

Beware the Headlines

The news media tends to express concern about the end of the current expansionary phase of the economic cycle with headlines often used to evoke strong emotions by using words such as "the coming crisis" or "the next crash," as if it were a certainty. In addition to media’s need for hype to attract eyes, much of this attitude stems from the traditional view of an economic cycle as an "N-shaped" animal with a regular and repeated form. Incorrectly applied, this view can have the impact of over-reaction, where people defensively prepare for a crisis, which may end up costing them far more in lost opportunity. What does a real "crisis" look like? Well, a sub-prime lending collapse is one example. Regulation and restraint appear to be a governor on any massive bubbles in the current environment.

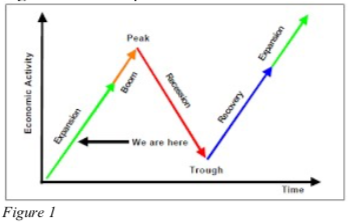

Figure 1 below represents the traditional view of the N-shaped cycle:

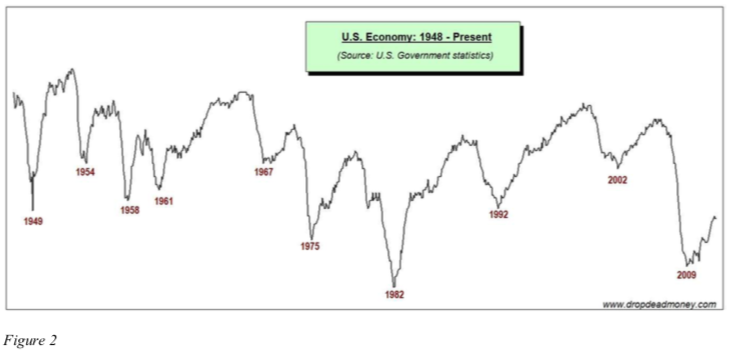

This view of an economic cycle is very simple, and generally accurate. However, it’s Achilles heel in predictive economics is that it does not account for degrees of severity. For example: if the N-shaped model were applied to the period from 1991-2005, would that be a correct application? Probably not: during that period the US endured a very mild (historically speaking) recession, or "trough" in 2001, which realistically created more opportunity than real pain for investors. The bottom right of the "N" simply didn’t reach that bottom. Later, considering the period from 2002 to (roughly) 2012 shows there was a legitimate "crash," affectionately known as the Global Financial Crisis in 2008-9, with a far more painful outcome for almost everyone. In both cases, there is very little of the discernible "N" shape in play. In fact, the 2002-2010 period looks more like a coat hook, as in Figure 2 below.

This perspective of economic volatility since WW II more clearly illustrates degrees of severity versus the simplistic view. With it, we can see that the "N-shaped" model is not the boots on-the-ground reality very often. In fact, Figure 2 reveals the reality that often, there is a relatively mild downturn in between the more serious peaks and troughs and, importantly, those milder downturns tend to follow periods of relatively long, slow growth. With US GDP growing extremely slowly, at an average of just 1.94% from 2009-2017 (versus the long-term average of 3.20% since 1948), we believe the current economy has been following this pattern.

Clearly, severity is not reflected in a simplistic model, while at the same time, it matters to how businesses need to conduct themselves. So, how do we solve for it? The economy is a complex and psychologically dependent animal, so the only good answer is to manage real-time data and take headlines for what they’re worth: hype.

Current Outlook

With the above context in mind, we see that the US economy is continuing to grow, and several key measures of the core economy continue to rise, suggesting further growth in 2019. There are several indicators experiencing a slowing rate of growth, and their trajectory suggests the economy may correct by late in the year or more likely in early 2020. This mixed bag of data may mean we are ultimately looking at a recession, or perhaps just a slowing without actual negative GDP, but not likely a "crash" or a "crisis." In fact, right about now is when we’ll probably start to hear about the possibility of a so-called "soft-landing." Of course, there are also areas of risk, some of which can be quantified.

The following factors are worthy of attention:

- The US Conference Board Leading Indicator declined in November, which was the second consecutive month of slowing, which when we look back may make September 2018 the peak for this cycle.

- Nondefense Capital Goods orders are slowing and trending toward contraction in late 2019-early 2020.

- Industrial Production growth is slowing, but not as much as was expected. November’s gain was revised upward to 0.4%, and the index rose 0.3% in December, both in line with expectations, leading to a 4Q annualized rate of 3.8%, which was down from 4.7% in 3Q. However, there was a positive surprise lurking behind the numbers: December Manufacturing Output was up 1.1%, the biggest gain in 10 months, and Capacity Utilization rose to 78.8% in December, the highest level in almost four years. These are some very strong showings. However, considering that the Purchasing Manager’s Index has been generally declining since mid-year 2018, we will likely see a declining rate of growth in Industrial Production through most of 2019.

- Private Sector Employment growth is likely to continue its bumpy but generally slowing growth pattern through the year. That said, employment growth is expected to stay positive without an actual contraction.

- Headline CPI increased 1.9% YOY in December, the first reading below 2% since August of 2017. Core Consumer Inflation (CPI adjusted for food and energy) has grown much more steadily, right at 2% YOY.These are right on target for Fed policy.

Most importantly for the US economy, Total Retail Sales are continuing to expand robustly, boosted by the overall employment picture and (finally) some growth in wages. Total Retail Sales during the 12-months through November were up 5.2% year-over-year (EOY data is not available as of this writing due to the government shutdown) and will likely also slow as we move through 2019, but it will trend more toward the 3% growth-level over the next 12-18 months rather than anywhere near contraction. After this slowing, the overall economy is likely to be expanding again considering the data mentioned above, which will add fuel for further consumer spending and potentially significant economic growth thereafter. Meanwhile, although consumer prices have increased, the near-term rate of inflation will also likely be dampened by factors at the wholesale level, as price competition sets in. Notably, e-commerce sales were up 16% in 2018 to over $525 billion; a new record.

Now let us address the risks to the potential economic growth noted above:

Risks: Stock and bond markets? Yes.

The US stock and bond market volatility, felt most poignantly in December, is being amplified by programmatic trading: computers with fixed orders, executed in massive volume. In 4Q 2018 alone, we saw the Dow drop from a high of 26,800 to a low of 21,700; a change just shy of 20%, which had it been achieved would have met the common definition of a bear market. But it has not yet. Also, in 4Q, the 10-year treasury yield spiked to over 3.23% and then dropped back down to the 2.76% level it held for most of the rest of the 2018, a very volatile 47 basis point range.

Ultimately, due to institutional influence and programmatic trading, market volatility should no longer be viewed as a reflection of true "investor sentiment." However, the impact of a market swoon on the individual investor and the psychological "wealth effect" we all feel is quite meaningful and should not be overlooked. After all, economic perceptions drive economic reality. The market’s dive caused many to wonder whether a bear market would portend a recession in the near-term, and change behavior accordingly, which could in fact then help bring on such a recession. Historical data suggest that severe market downturns don’t tend to cause economic decline, and in fact they tend to be short when GDP isn’t also on the down-swing, which it clearly is not. However, a continuance of negativity in the stock market could certainly impact consumer spending habits, which as discussed above is the "magic dust" of the US economy, so the attitude could easily have more dire consequences.

Risks: Interest Rates? Yes.

Related to the bond market discussion above, the single greatest risk to economic growth remains interest rates: how the Fed manages Federal Funds Rate policy and how Treasury markets respond. With rates appearing in check as we enter 2019, US federal debt is not a risk to economic growth right now, but it can become a risk very quickly if spikes in rates do occur. This is something to watch very closely.

Risks: Global slowdown? Yes.

There has also been a significant amount of press related to a "global slowdown" in economic activity, most poignantly in China (slowing from a rate of over 12% in 2011 to less than 6.5% in 2018), which will reverberate to the US and put further pressure on growth. It is a reality that global growth is slowing, and while nowhere near crisis levels, that should be a concern for a globalized economy like the US, particularly after finally achieving oil independence and trending fast to becoming a net-oil exporter barring a disruption in global demand. A global economic slowdown could dampen demand for US oil and create a glut, keeping prices soft, leading to slowdowns in domestic production.

Risks: Trade? Maybe.

What can we say about trade? At the risk of misinterpretation, we believe the Trump administration is doing nothing more than using tariffs as a tool in hard-ball negotiations, and that at the heart of things they are not fundamentally a tariff-oriented administration. In the end, the philosophy is about free and "fair" trade rather than being about protectionism. Our evidence is that NAFTA has been revised, positively to the US worker; we have a new positive trade deal with South Korea; a theoretical deal is in place with the European Union, subject to the question of whether they will follow through; and most importantly, China talks appear to be progressing positively as of this writing, with mounting pressure on China from their slowing economy, as exacerbated by tariffs, to make a deal. Whether talks will be successful remains to be seen, but there is no mistaking that the benefits of restructuring trade agreements toward a freer-trade objective will benefit the US economy.

Risks: Yield Curve Inversion? Maybe.

Yield-curve (the difference between 2-year and 10-year Treasury yields) inversion is not a risk by itself, but it’s legacy as an indicator of coming recessions is noteworthy. Long-term interest rates are controlled by the markets, while short-term interest rates are controlled by Fed policy. Foreign demand for Treasury bonds continues to be strong and may grow with global growth uncertainty, putting downward pressure on longs. Until recently it was assumed that shorts would continue to rise through 2019, but comments from Powell and other governors this month has left a broadly interpreted position that rate increases will pause, and odds now favor two increases in 2019 rather than four. So, the curve, while alarmingly flat, may not indeed invert. As a harbinger of each of the past 5 recessions, and most others dating to 1960, this would be good news in terms of avoiding actual GDP contraction.

Risks: Taxes? No.

The economy received a boost in 2018 from tax reform, but the economic benefit of more money in worker paychecks began to wane as the year went on. Meanwhile, businesses utilized their lower rates to hire aggressively, driving record low unemployment, and also expand investment in capital goods. Going forward, we believe that one of the most important provisions in the new law will positively impact individual taxpayers again in Spring of 2019: the increased standard deduction. We believe there is likely to be a corresponding shot in the arm to consumer spending in the middle of the year as a result. For 2019, tax policy itself does not present a risk. On the other hand, the 70% top-tier income tax rate suggestions currently making the news? That would be an unqualified disaster. Such policy has zero chance of becoming reality in 2019, but depending on election outcomes at the end of 2020, if you’re looking for a "black swan" in the future, there it is.

Conclusion

There does not appear to be a single meaningful identifiable risk factor that has the power to have recessionary implications as we enter 2019. If there is one, it is remaining hidden. Accordingly, the data shows that there may be several reasons the US economy may experience a disruption, but very likely not reaching crisis levels. 2019 has the potential to see a continuation of growth, albeit slower. That forecast, with consideration to the number of economic question marks becoming more abundant, suggests a cautious but not defensive posture as warranted.

As is typical of economic slowdowns, we anticipate an increase in opportunities in real estate equities as institutional investors become defensive and capital becomes less abundant. Prudent application of available private investment capital can begin to produce above-market returns. For further detail, please see Part II- TCG 2019 Investment Strategy, which will be issued shortly.

Popular POSTS

Triumph leases up Denver business center

14 February, 2017

TCG 2019 Economic Forecast & Investment Strategy

5 January, 2019

The future of industrial real estate is now thanks to retail

5 February, 2014

Interested in investing in industrial real estate? Why?

31 January, 2016

Supply Chain

31 January, 2016

Fort Mill deal featured in Charlotte Business Journal

15 January, 2016

The Impact Of Driverless Trucks On The U.S. Warehouse Market

6 August, 2019

Are increasing tariffs impacting demand for warehouses?

19 November, 2019

Logistics real estate risk in the age of COVID-19

13 January, 2021

ABOUT FORBES COUNCILS

Popular POSTS

Triumph leases up Denver business center

14 February, 2017

TCG 2019 Economic Forecast & Investment Strategy

5 January, 2019

The future of industrial real estate is now thanks to retail

5 February, 2014

Interested in investing in industrial real estate? Why?

31 January, 2016

Supply Chain

31 January, 2016

Fort Mill deal featured in Charlotte Business Journal

15 January, 2016

The Impact Of Driverless Trucks On The U.S. Warehouse Market

6 August, 2019

Are increasing tariffs impacting demand for warehouses?

19 November, 2019

Logistics real estate risk in the age of COVID-19

13 January, 2021

Popular POSTS

Triumph leases up Denver business center

14 February, 2017

TCG 2019 Economic Forecast & Investment Strategy

5 January, 2019

The future of industrial real estate is now thanks to retail

5 February, 2014

Interested in investing in industrial real estate? Why?

31 January, 2016

Supply Chain

31 January, 2016

Fort Mill deal featured in Charlotte Business Journal

15 January, 2016

The Impact Of Driverless Trucks On The U.S. Warehouse Market

6 August, 2019

Are increasing tariffs impacting demand for warehouses?

19 November, 2019

Logistics real estate risk in the age of COVID-19

13 January, 2021

All US rail traffic is up as happens anytime the economy grows, but interesting to note is that according to Rail-Time Indicators (“RTI”), a publication of the American Association of Railroads, Intermodal freight traffic was up 5.2% in 2014 YOY and set a new annual record.

Overall, RTI reports that in 2014 total carloads reached 15.2 million, the highest since 2008 but still 12.3% below the peak of 17.3 million reached in 2006. So despite the sporadic reports we hear of heavy energy traffic stretching rail capacity to its limits, it is clearly not the case.

Not unexpectedly based on our research on the shifting of supply chain dynamics in the US, the percentage of container shipments has continued to increase as a percentage of all intermodal traffic since 1990, while the percentage of trailers has continued to decrease.

Popular POSTS

Triumph leases up Denver business center

14 February, 2017

TCG 2019 Economic Forecast & Investment Strategy

5 January, 2019

The future of industrial real estate is now thanks to retail

5 February, 2014

Interested in investing in industrial real estate? Why?

31 January, 2016

Supply Chain

31 January, 2016

Fort Mill deal featured in Charlotte Business Journal

15 January, 2016

The Impact Of Driverless Trucks On The U.S. Warehouse Market

6 August, 2019

Are increasing tariffs impacting demand for warehouses?

19 November, 2019

Logistics real estate risk in the age of COVID-19

13 January, 2021

If your answer is something along the lines of “good fundamentals,” then you’re probably chasing deals in the same 20 markets as everyone and their cat. This herd mentality is fine and there are certainly risk-related analyses to justify the approach, but the ability to deploy capital in those markets is becoming increasingly about how low you are willing to accept yields. The approach may also not be doing justice to the question as to why fundamentals are good in the first place. It’s not because of a bourgeoning US economy.

Fundamentals in US industrial real estate are strong because of e-commerce (and m-commerce and s-commerce, while we’re at it). It’s a for-real paradigm shift of the kind not seen since the industrial revolution, and if you’re not paying attention to the idea that such a shift will change every bit of the very supply chain itself, you may also be missing opportunities.

Thinking outside the box is no cliché in this arena. The new world of e-commerce has already shaken the retail real estate industry so dramatically that store locations and footprints and their very use (is it a store or a distribution center?) are all being called into question. Can big-box retailers really continue to “pay the freight” (pun intended) to open a store in a high-priced location if over 50% of the goods purchased will come from online orders and be shipped out to the customer’s home without the customer ever setting foot in the store? And can big-box distribution centers adequately deliver goods next day or same day to Boise all the way from Nashville? We believe that thinking outside the box in this environment means decentralization: smaller facilities closer to population centers.

Aside from delivery challenges, the efficiencies of the supply chain are being challenged further by changes in the shipping industry: cost pressure, overcapacity, Panama Canal expansion, continuing labor union struggles, and a newly emboldened anti-trust regulator in China putting the squash on P3, to name a few.

The bottom line is that to maximize the potential returns in the industrial niche, one must think in terms of the new dynamics from the demand side and resist following the crowd to the next 5-cap deal in the obvious markets. New critical locations are emerging. Intermodal has arrived. New requirements are being placed on facilities in those locations. Those who solve the puzzle and venture forth to the new world will prosper.

Popular POSTS

Triumph leases up Denver business center

14 February, 2017

TCG 2019 Economic Forecast & Investment Strategy

5 January, 2019

The future of industrial real estate is now thanks to retail

5 February, 2014

Interested in investing in industrial real estate? Why?

31 January, 2016

Supply Chain

31 January, 2016

Fort Mill deal featured in Charlotte Business Journal

15 January, 2016

The Impact Of Driverless Trucks On The U.S. Warehouse Market

6 August, 2019

Are increasing tariffs impacting demand for warehouses?

19 November, 2019

Logistics real estate risk in the age of COVID-19

13 January, 2021

Triumph Real Estate was recently featured in the Charlotte Business Journal about it’s acquisition of the 260,000 square foot Fort Mill building near Charlotte, South Carolina.

This is Triumph’s first venture into the robust Southeast region of the United States, with hopefully more forthcoming.

See more in Charlotte Business Journal articlePopular POSTS

Triumph leases up Denver business center

14 February, 2017

TCG 2019 Economic Forecast & Investment Strategy

5 January, 2019

The future of industrial real estate is now thanks to retail

5 February, 2014

Interested in investing in industrial real estate? Why?

31 January, 2016

Supply Chain

31 January, 2016

Fort Mill deal featured in Charlotte Business Journal

15 January, 2016

The Impact Of Driverless Trucks On The U.S. Warehouse Market

6 August, 2019

Are increasing tariffs impacting demand for warehouses?

19 November, 2019

Logistics real estate risk in the age of COVID-19

13 January, 2021

As appeared in…Colorado Real Estate Journal

A few months ago, the manager of a major brokerage firm asked me whether we were interested in buying any retail projects right now. It was a reasonable question, because he knows we’ve been opportunistic investors and developers in all of the major commercial property types over our 15-year history. But, for once, my answer was uncharacteristically short: “No,” I said, “the truth is that the more we study retail, the more we want to buy industrial.”

The fact is that both retail and industrial real estate are undergoing a historic, fundamental shift in their utility. And as a firm that puts rigorous economic, demographic and political analysis at the forefront of its business decisions, that fact has us rather interested.

This isn’t to say that retail real estate is dead, it’s just that we believe it doesn’t know what it wants to be when it grows up yet. In many ways, the evolution of retail real estate is being forced to follow innovation led by the industrial/distribution sector. We believe the growth in the worldwide movement of goods coupled with shifts in consumer delivery expectations and highlighted by urbanization are forces that already have declared what the future of distribution must look like, and only after efficiencies are maximized in that sector will retail finally see what it needs to do to adapt. For those reasons we believe that as an asset class, industrial real estate has seldom been a more attractive long-term investment than it is now. After years of incubation, these forces are coming together and will change the economics of industrial real estate for decades in the future.

Fundamentally, industrial real estate is used for the production, storage and distribution of consumer goods. Manufacturing facilities are used to make products and, until now, a warehouse’s place in the supply chain was primarily a storage spot in between the manufacturer and the retail store, where the retail store played the role of final point of delivery to the customer. However, the manner in which products end up in consumers’ hands is being morphed by technological and sociological changes, and it is happening very rapidly.

The goal in today’s retail economy is to allow the customer to “buy anywhere, deliver anywhere and return anywhere.” This is the world of e-commerce: an interesting but miniscule purchasing trend just a few years ago that is now evolving into a fully disruptive agent in the business of supply chain management. It would appear in broad terms that the future of retail does not necessarily consist of more stores and shopping centers, but that the future of retail is warehouses, trucks and sophisticated logistics software. For retailers, efficient movement of goods trumps “location, location, location.” Physical stores still have a purpose, but the way people are using technology, retailers may not need to keep much inventory on site and it may become rare for people to actually walk out of the store with their goods.

This is forcing industrial real estate to adapt first. According to the World Trade Organization, over the past 63 years, global trade has been increasing at an average rate of 9.5 percent per year. Trade has nearly tripled since 2001, when China joined the World Trade Organization.

A recent article by Cushman & Wakefield research speculated that by 2021, approximately $45 trillion in goods could be moving around the world every year, compared with only $6.1 trillion as recently as 2001 (Cushman & Wakefield: “The Changing World of Trade, 2013”).

Further, the U.S. Census Bureau indicates that population in the United States is growing at an average of 2.5 million people annually. An article by Avison Young recently cited an estimate from Dr. Glenn Mueller of the University of Denver’s Daniels School of Business that “Each person consumes goods that require approximately 50 square feet of warehouse space” each year. Combined with population growth, “This equates to new demand for 125 million square feet annually.” (Avison Young: “E-commerce fueling demand for industrial distribution space,” June 2013).

Distribution logistics must become more efficient to handle that kind of growth, in the face of increasing population density in existing cores and consumer demands for fast delivery of products purchased online. All of which requires significant adaptation at the facility design level and strategic location analysis.

E-commerce

Omni-Channel models of goods procurement puts the greatest pressure on the logistics of delivering goods quickly and efficiently. Omni-Channel refers to the practice of consumers shopping and purchasing through multiple, rather than dual, channels; in this model customers can buy anywhere, fulfill anywhere and return anywhere. QR Code readers and barcode scanners are now everyday apps, and smartphone purchases are soaring. Digital Strategy Consulting reported that 59 percent of smartphone owners made a purchase with their device in 2012. (“Mobile shopping trends: Smartphone purchases doubled in 2012,” March 21, 2013). Some experts predict the use of the smartphone as a wallet will eliminate physical credit cards as soon as 2020.

In the new world of e-commerce, in-store distribution of goods will continue to exist, but by adding direct-to consumer orders, “click-and pick” outlets, “dark stores,” courier services and possibly drone delivery to the mix, it becomes crystal clear that the status quo must change. In the new e-commerce supply chain model, import (port related), inland-hub (regional distribution), fulfillment centers and just-in-time facilities all run simultaneously.

Already, according to Jones Lang LaSalle in its “Industrial Outlook, North America 2Q 2013,” “retail-related (chiefly consumer goods distributors) and logistics companies (are creating) the bulk” of demand for industrial space, a trend that has been consistent over the past several years. As such, the next phase of e-commerce will have a dramatic impact on the industrial real estate market. To satisfy customers’ desire for quick turnaround, site selection by distributors is driven by proximity to customer demand for their products. “Multiple, well-placed distribution centers are being employed to minimize the time and distance spent on the final leg of delivery,” notes the C&W report. Backing these up will be large distribution facilities that support both the online and the in-store inventory, so these facilities will be farther out from central cores to lower costs but must still be close to an affordable workforce and have access to rail, highways and air transportation. Location decisions will be strategic for each supplier and there will be fewer industry-wide location trends.

Urbanization

Demographic estimates by the United Nations indicate that some 3.6 billion people live in urban locations, which is roughly half of the world’s population. More importantly, the U.N. predicts that number may more than double by 2050. In order to get products into consumers’ hands in these dense locations, retailers must solve some difficult logistical challenges, particularly traffic congestion and real estate prices in urban cores.

“The large Generation-Y demographic cohort orients away from the suburbs to more urban lifestyles, and these young adults willingly rent shoebox-sized apartment units as long as neighborhoods have enticing amenities with access to mass transit,” notes PricewaterhouseCoopers and the Urban Land Institute in “Emerging Trends in Real Estate, 2013.” Further, not only do they not care to get in their cars to go to the suburbs to shop for what they need, but also they don’t even want to own cars.

One key impact from this trend is that urban distribution centers will necessarily be more expensive due to higher land prices compared to outlying locations, and rents will be correspondingly higher, but only relative to the opportunity cost of having facilities farther away. For many, there is an algorithm for their particular product line that determines the tradeoff. Most importantly, it is key to note that in the U.S., efficient urban distribution facilities do not yet exist in any great volume.

Lastly, multiple locations will be required for each retailer/distributor in order to maximize logistical efficiency. So the advantage will go to the warehouse provider that can support automation and offer the best location options.

Obviously, we are witnessing dramatic changes in the global movement of goods, technological and sociological changes which are driving change in the methods of delivery of goods to consumers and transportation logistics, all of which affect industrial real estate in the U.S. and globally. As the world’s largest economy and importer, the United States must immediately initiate a significant overhaul of its industrial facilities in the coming decade and dramatically add to the supply of space, particularly in critical locations. Building modifications and retrofit of functionally obsolete buildings in top-quality locations will provide some of the most rapid solutions, while immediate ground-up development is required in a number of the fastest-growing areas. The future is now, and the time is right for distribution to come of age.

Paul is a highly sought after speaker in the industrial Real Estate Industry because of his immense knowledge of e-commerce logistics and “Last-Mile” distribution. In September, he has been asked to moderate a panel at the NAIOP Educational Series focused on urban-infill redevelopment and value-add real estate investing. In October, Paul will be a speaker at ULI conference in Los Angeles. Previously, he either chaired panels or been a speaker at the annual Colorado Real Estate Journal’s Industrial Summit and Expo (2015 speaker and 2016 chair) covering topics on E-commerce and last mile distribution.

Popular POSTS

Triumph leases up Denver business center

14 February, 2017

TCG 2019 Economic Forecast & Investment Strategy

5 January, 2019

The future of industrial real estate is now thanks to retail

5 February, 2014

Interested in investing in industrial real estate? Why?

31 January, 2016

Supply Chain

31 January, 2016

Fort Mill deal featured in Charlotte Business Journal

15 January, 2016

The Impact Of Driverless Trucks On The U.S. Warehouse Market

6 August, 2019

Are increasing tariffs impacting demand for warehouses?

19 November, 2019

Logistics real estate risk in the age of COVID-19

13 January, 2021